cash app 600 dollars

Before the threshold was much. The Internal Revenue Service IRS will be changing the way it is taxing businesses that use third-party payment services such as Zelle Venmo and Cash App to receive payments for their goods and.

Cashapp Stop Screwing Me Over My Lights Are Out Right Now I Have Bills To Pay R Cashapp

That is not true.

. Buried inside the 600-page bill thats ostensibly meant to provide pandemic relief is a provision requiring gig economy platforms to report information to. For the 2022 tax year you should consider the amounts shown on your 1099-K when calculating gross receipts for your income tax return. Those posts refer to a provision in the American Rescue Plan Act which goes into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to.

Currently this feature is being offered by 1000 users. Now you have more insight on the fees. Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS.

Starting in 2022 mobile payment apps like Venmo PayPal Cash App and Zelle are required to report business transactions totaling more than 600 per year to the IRS. Make 600 fast by playing games on your phone Im serious For the first of different ways to help you make 600 fast I am focusing on making money while playing games on your phone. Cash App Offering Loans Of 20-200 With 60 APR.

Cash app payments over 600 will now get a 1099 form according to new law Fortunately the idea that you will have to pay additional taxes is false. PT Israel SebastianGetty Images If youre self-employed or have a side hustle and get paid through digital apps. That is because a 1099-K form will be sent out to app users who receive more than 600 in total transactions beginning in 2022.

1 The new rules came into effect on January 1. But the downside is that you can only send money within the US and to the UK when using Cash App. Squares Cash app is beta testing a new feature where users can borrow 20 to 200 the loan length is four weeks and cash app is charging a flat fee of 5 multiplied by 52 weeks is 60 or almost 80 with compounding interest.

The IRS is cracking down on payments made through third-party apps requiring platforms like Venmo PayPal and Cash App to report transactions if. The online payment giants have been told that from January 1 they must report commercial transactions of that value or higher. The new change will apply for the 2022 tax season.

Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS. These two apps will PAY YOU to play games on your mobile. 30 2021 Published 301 pm.

28 2022 730 am. 1 mobile payment apps like Venmo PayPal Zelle and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others.

VENMO PayPal Zelle and Cash App must report certain 600 transactions to the Internal Revenue Service under new rules. If you receive 600 or more payments in total for goods and services through a third-party payment network such as Venmo Cash App or. Its now just one requirement 600.

Millions of small business owners who rely on payment apps like Venmo PayPal and Cash App could be subject to a new tax law that just took effect in January. Will You Owe Taxes. As part of the 2021 American Rescue Plan Act ARPA the IRS is requiring these electronic payment apps to report transactions totaling over 600 per year.

Payment apps like Venmo Zelle Cash App and PayPal would fall under that category. Beginning this year third-party. Load Error Before the new rule business transactions were only reported if they were.

The cash apps will now be required to send the 1099-K form to businesses with electronic transactions greater than 600. Hello Fraudsters Best Carding Forum Community - Carder Forum - Offering Worldwide Western union Transfer - Cash App Transfer - PayPal Transfer - High Quality Bins and HQ dumps on Perfect Rates. Before the new rule business transactions were only reported if they were more than.

With a Cash App instant transfer your money will be transferred instantly to your linked card¹. Department of Treasury claiming a new tax will be placed on people who use cash apps to process transactions. Cash App Venmo users receive 1099-K for payments over 600 anjunrama September 30 2021 Social media users claim that anyone with annual transactions from cash apps over 600 will face new taxes.

This is the IRSs description of the form. The ARPA change took effect on January 1 2022 and third-party networks are gearing up. Venmo Cash App And Zelle Now Required To Report Transactions Over 600 To IRS And Users Are Upset Grocery stores are struggling to stock their empty shelves Michelle Obama Celebrates Maya Angelou.

Thats right you may be able to earn hundreds of dollars right from the comfort of your couch. The Form 1099-K is simply reports of transactions its actually a summary that happen and unlike a Form W-2 doesnt mean you owe any taxes at all. Woman using cash app on phone Photo credit Getty Images By Miles In The Morning Jeff Miles Rebekah Black and Alex Luckey 987 KLUV October 4 2021 645 am.

People on social media are freaking out over claims that the Biden administration. Cash App Wont Have New Taxes in 2022 Despite Claims. The Cash App instant transfer fee is 15 with a minimum of 025.

As of Jan. Some social media users have criticized the Biden administration Internal Revenue Service and the US.

Just Got My 600 1 Minute Ago W O Pending R Cashapp

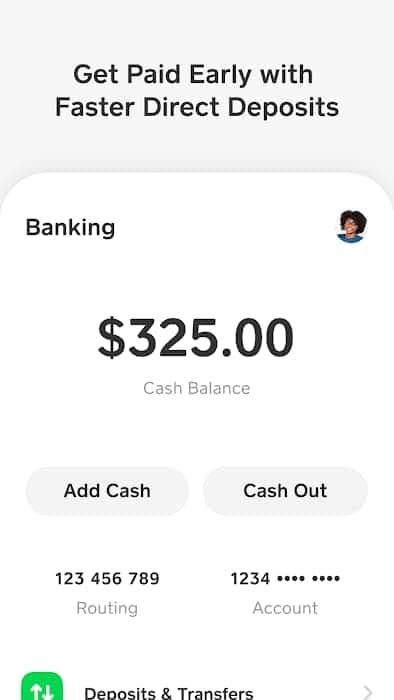

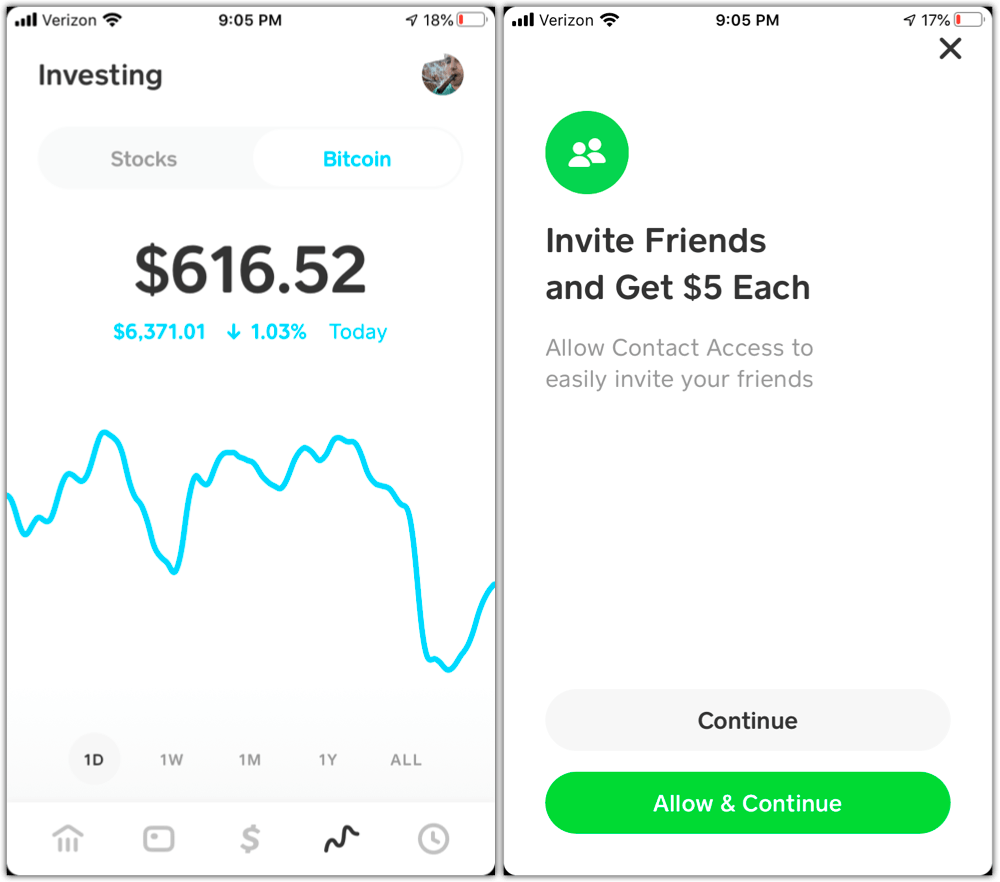

Cash App The Easiest Way To Send Spend Bank And Invest

Cash App Scams Legitimate Giveaways Provide Boost To Opportunistic Scammers Blog Tenable

How To Direct Deposit On Cash App Step By Step

Sugar Mummy Sugarmu79687101 Twitter

Can You Really Make Money With The Cashapp App One More Cup Of Coffee

How To Increase Your Cash App Limit By Verifying Your Account

0 Response to "cash app 600 dollars"

Post a Comment